期权卖方赚钱法宝—希腊字母Theta

期权卖方(Call Seller/Writer)是指卖出期权合约的一方。可以卖出的标的物有:认购期权(看涨期权)和认沽期权(看跌期权)。开仓卖出期权通常称为建立期权空头(Options Short)头寸。针对期权卖方来说,主要的盈利方式是赚取“时间价值”,针对时间价值,期权中用Theta来计算。

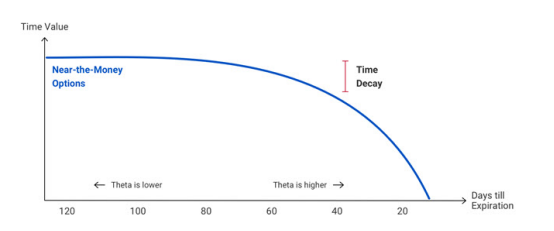

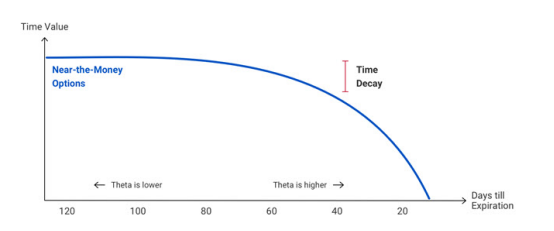

无论看涨期权还是看跌期权,随着时间的流逝价值都会逐渐下降。Theta主要是测量时间变化对期权价值的影响。表示时间每经过一天,期权价值会损失多少。一般在期权软件上都是显示期权价值每日下降的点数。如果告诉你一个期权的Theta是-0.06,就表示在其他条件不变的情况下,期权价格会每天下降0.06,如果期权今天的价值是9.06,那么明天期权的价值就是9。随着到期日的临近,时间价值损耗会加速。Theta以非线性方式影响期权价值。

Theta的正负该如何理解?

跟之前的希腊字母Delta,Gamma一样,先看Theta的符号。显然从定义上看,Theta表示的是期权价值随时间的损失,所以对期权的买方来说,Theta值一般写成负值,而对于期权的卖方来说,天然赚取时间价值的钱,所以写成正的。

当你选择作为期权买方,就选择了对抗自然规律—与时间损耗为敌,必须克服其对期权价格的下拉作用。这张合约从诞生之日起,直至到期,每一天期权的外在价值都在减少。这就好比一辆装满河沙的卡车,在开往目的地的途中,不断将沙子漏在地上。如果我们把这些「沙子」全部拾起,算一个总数,会发现刚好等于期权合约的外在价值。而卖方恰恰赚的正是这些每天不断漏在地上的沙子。

作为期权买方,拥有了正Gamma,且损失一开始就是确定的(风险兜底) ,但它的Theta却为负数。作为期权卖方,虽然是负Gamma,损失可能会很大(风险开口),但却拿到了正Theta,利用时间损耗赚钱。

Theta与到期日和执行价的关系

执行价方面,平值期权附近的Theta读数最大,而分别往两边,进入ITM或OTM状态,Theta都在逐渐缩小。

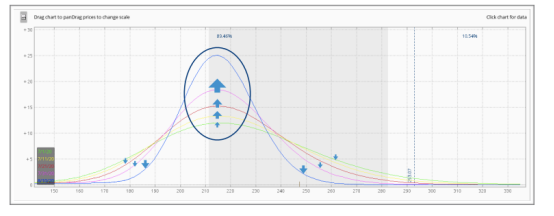

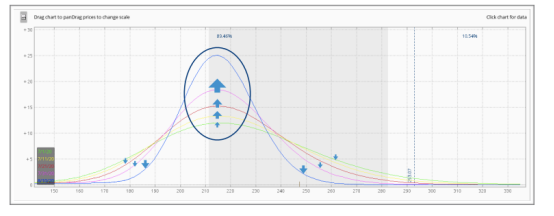

随着到期日临近,如果期权合约处在平值状态附近,Theta曲线会被逐渐抬高,Theta读数增大。如果期权合约处在深度OTM或深度ITM状态,Theta曲线会被逐渐压低,趋近于X轴,Theta读数缩小。

这意味着越靠近到期日,靠近平值状态的期权的外在价值会加速衰减。而深度的实值或虚值状态,外在价值衰减的速度反而慢了下来。

Theta与波动率

Theta还和一个重要因素有直接关系,这个因素便是波动率。期权卖方总是想要在波动率高的时候卖期权,也是因为波动率和期权的Theta绝对值成线性正比。这意味着,波动率越高,期权的Theta绝对值便越大,越有利于卖方赚取时间值。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.